The Rise of ESG-Linked Bonds in the UAE: A Sustainable Finance Revolution

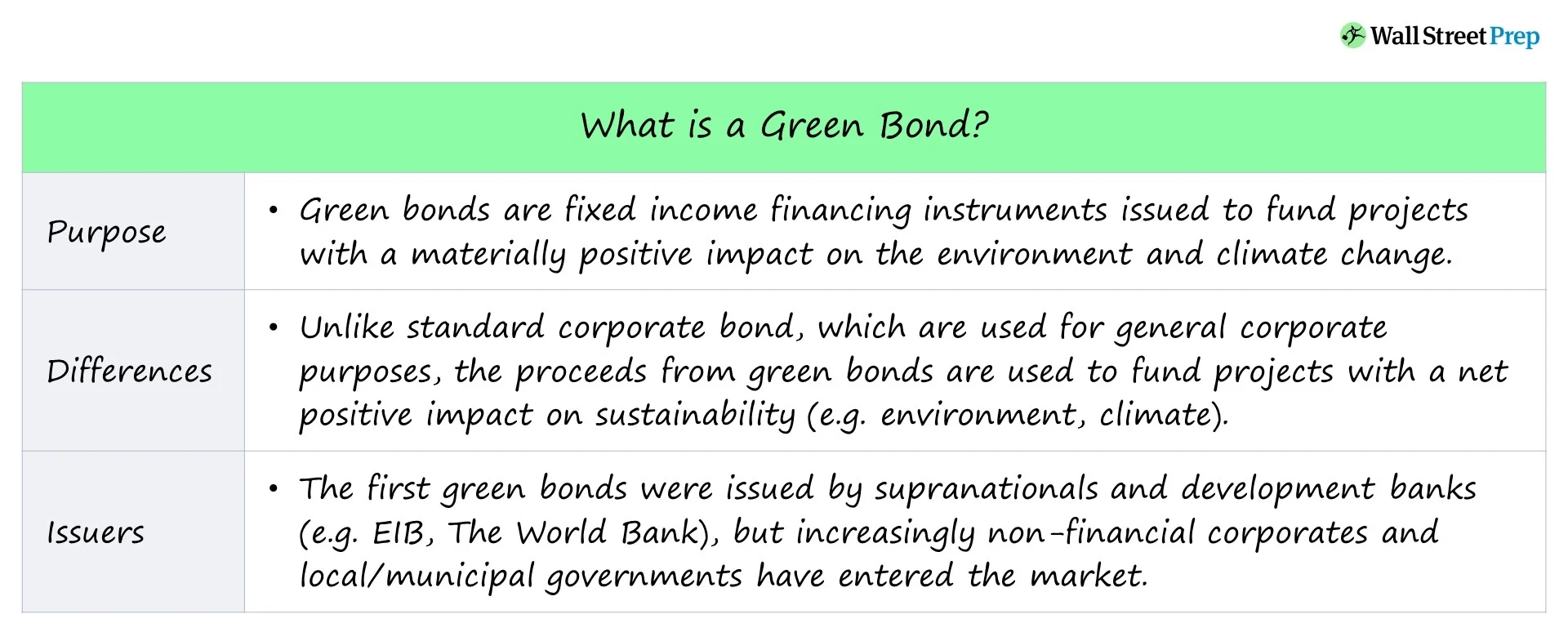

Introduction The United Arab Emirates (UAE) is rapidly emerging as a global leader in sustainable finance, driven by a surge in ESG-linked bonds. As climate change, social impact, and corporate governance issues dominate investment agendas worldwide, ESG-linked bonds have gained momentum, particularly in the UAE’s forward-looking financial ecosystem. These instruments are reshaping capital markets by […]